7 Key North American Construction Trends for 2026

As we head in 2026, the North American construction landscape continues to shift under pressure from labor shortages, material cost volatility, sector growth, and sustainability requirements. For architects, engineers, and other design professionals, these shifts are already influencing how projects are planned and products are specified.

Understanding where the market is headed isn’t just about staying informed—it’s about making smarter design decisions, managing risk, and positioning projects for success in a rapidly changing environment.

In this blog, we break down seven key construction trends shaping 2026, highlight the most important data behind them, and explain what each one means for you and your projects.

Persistent Labor Shortages

Data Center Construction Surge

Material Cost Inflation & Tariff Pressures

Residential Slowdown, Infrastructure Growth

Sustainability & Net-Zero Retrofit Mandates

Modular Construction Scaling

Rising BIM Adoption Rates

Photo by Tuaans on Unsplash

1. Persistent Labor Shortages

The construction labor gap remains one of the industry’s most pressing challenges. In 2025, the U.S. construction sector needed to attract about 439,000 net new workers just to meet demand, and that number is projected to rise as work increases in 2026 with the need for 499,000 new workers. This shortage continues to strain project delivery, wage growth, and scheduling across markets.

Labor challenges include difficulty filling craft positions, and a workforce that is aging faster than new entrants can replace retirees. This gap influences everything from cost escalation to extended timelines, making workforce development and talent retention strategic priorities.

What this means for you: Labor constraints make constructability and efficiency more critical than ever. Designs that reduce onsite labor, simplify installation, or support prefabrication and modular approaches can help mitigate schedule risk and improve project feasibility.

2. Data Center Construction Surge

As the backbone of digital infrastructure, data centers remain one of the fastest-growing construction sectors. Activity jumped about 33% in 2025 and is expected to climb another 20% in 2026, fueled by expanding AI workloads and cloud capacity.

The rapid expansion of data center construction also ties directly to rising energy demands. According to The Wall Street Journal, data centers are expected to consume more electricity than Japan does today by 2030, with demand from AI-optimized facilities alone projected to quadruple as AI workloads expand.

What this means for you: Data center projects demand specialized design considerations, like power distribution, cooling strategies, redundancy, fire protection, and resilience. Energy constraints and grid capacity will increasingly shape site selection, system design, and material choices early in the project lifecycle.

3. Material Cost Inflation & Tariff Pressures

Construction input prices and material cost trends continue to exert pressure on margins and budgets. Though specific year-over-year percentage increases vary by material and region, industry reporting shows tariff-affected goods like iron and steel experienced accelerating price rises through 2025, leading to unpredictability in procurement.

This volatility can add thousands to project costs and complicate budgeting amid tight financing conditions. For example, tariffs on imported building materials have been linked to increases in homebuilding expenses, widening the gap between market demand and construction capability.

What this means for you: Fluctuating material costs increase the importance of early coordination, value engineering, and flexibility in specifications. You may need to evaluate alternative materials, systems, or assemblies more frequently as pricing and availability shift.

4. Residential Slowdown, Infrastructure Growth

Some segments like single-family residential are expected to see only modest rebounds in 2026, while other areas such as infrastructure (power, water) may show stronger growth. According to industry forecasts, nonresidential construction may grow modestly (~2.6%), but data center, aviation, and water infrastructure segments are outpacing the broader market.

What this means for you: Firms working across both private and public sectors may see more stability by diversifying their project mix. Infrastructure projects often involve longer timelines, higher regulatory complexity, and more rigorous documentation, placing greater emphasis on early design coordination and access to clear, spec-ready product information from platforms like CADdetails.

5. Sustainability & Net-Zero Retrofit Mandates

Sustainability requirements are steadily accelerating across North America:

In Canada, major construction projects must meet government-mandated embodied carbon reduction requirements, including a 30% reduction target and aggressive retrofit rates with the goal of achieving net-zero emissions by 2050.

In the U.S., Building Performance Standards (BPS) at the state and local level are being adopted to require emissions and energy performance improvements in existing building, often tightening targets over time and compelling retrofits. At least 40 cities are expected to have building performance standards in place aimed at net-zero or emissions-reduction goals for existing structures by the end of the year.

What this means for you: Sustainability is no longer optional. You’re increasingly expected to evaluate embodied carbon, lifecycle impacts, and retrofit strategies as part of standard project workflows, especially for public and large commercial projects.

6. Modular Construction Scaling

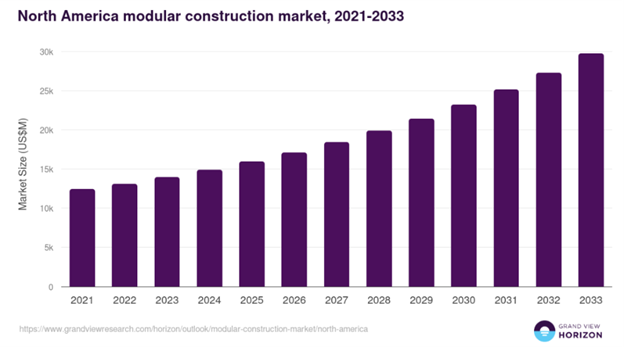

Modular and prefabricated construction is becoming more common as builders look for ways to manage labor shortages and rising costs. In North America, the modular construction market is expected to reach nearly $29.7 billion by 2033, growing at about 8.2% annually between 2026 and 2033.

What this means for you: Modular construction shifts more decision-making upstream. Clear documentation, standardized dimensions, and coordination-ready BIM models are essential to ensure prefabricated components integrate smoothly your the overall design.

7. Rising BIM Adoption Rates

Building Information Modeling (BIM) is now standard across the AEC (Architecture, Engineering, and Construction) industry. According to the AIA Firm Survey Report 2024, 95% of large firms and 88% of mid-sized firms use BIM as a core part of their practice. Design firms are also increasingly using AI-powered tools for automation and clash detection, reflecting a growing reliance on digital-first project workflows.

What this means for you: High-quality BIM content, reliable digital product data, and seamless integration into modeling environments are essential for efficient design and coordination. Easy access to trusted, spec-ready files from CADdetails can save time, reduce rework, and improve collaboration across disciplines.

Actionable Takeaways for Design Professionals

As these trends shape the construction landscape in 2026, you can prepare by:

Designing with constructability and labor efficiency in mind

Anticipating energy and infrastructure constraints, especially for data center project

Building flexibility into specifications to manage material cost volatility

Integrating sustainability metrics early in the design process

Strengthening digital workflows with BIM-first, data-driven practices

Staying ahead of these trends helps AEC professionals not only navigate market uncertainty, but also deliver more resilient, efficient, and future-ready projects.

Looking for the right products for your next project? Find the perfect fit on CADdetails.

Author: CADdetails

Cover image by C Dustin on Unsplash